Introduction: Have you ever wished that you could make your rich uncle jealous? Maybe he’s always flaunting his wealth and telling you about his latest investment successes. Well, it’s time to turn the tables and make him envious of your financial savvy. And the best way to do that? Mutual funds!

If you’re new to investing, mutual funds can seem daunting. But fear not, dear reader. In this blog, we’ll break down what mutual funds are, how they work, and why they’re the only way to make your rich uncle jealous. And of course, we’ll show you how FundsVita can help you get started.

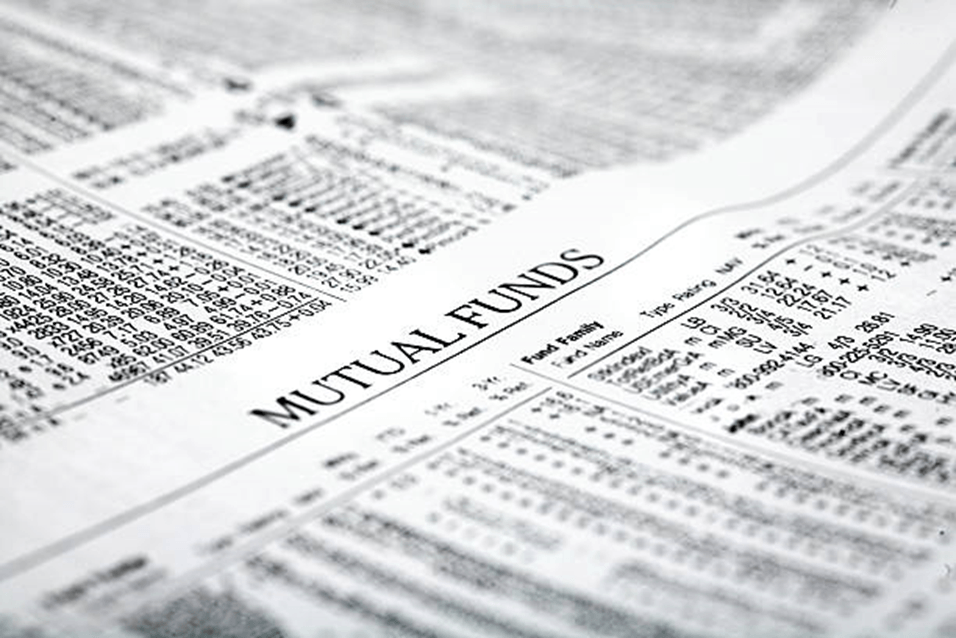

What are mutual funds? At their most basic level, mutual funds are a collection of stocks, bonds, and other securities that are managed by a professional investment manager. When you invest in a mutual fund, you’re pooling your money with other investors to buy a variety of different assets. This allows you to diversify your portfolio and reduce your risk.

Mutual funds come in many different types and styles. Some funds invest in a particular sector, like technology or healthcare. Others focus on a particular investment style, like value or growth. And still others invest in a mix of different assets, like stocks, bonds, and cash.

How do mutual funds work? When you invest in a mutual fund, you’ll typically buy shares in the fund. The price of these shares is determined by the value of the underlying assets in the fund. This means that if the value of the assets goes up, the price of your shares will go up too.

One of the great things about mutual funds is that they’re highly liquid. You can buy and sell shares of a mutual fund at any time during the trading day, and you’ll receive the current market price for your shares.

Why are mutual funds the only way to make your rich uncle jealous? Now that you know what mutual funds are and how they work, let’s get to the good stuff: why they’re the only way to make your rich uncle jealous.

First, mutual funds give you access to a wide range of investments that you might not be able to afford on your own. For example, you might not be able to buy shares in Apple or Amazon, but you can invest in a mutual fund that owns those stocks. This means that you get to benefit from the growth of these companies without having to spend a fortune on individual shares.

Second, mutual funds are a great way to diversify your portfolio. By investing in a variety of different assets, you can reduce your risk and potentially earn higher returns. And let’s face it, your rich uncle probably doesn’t have a diversified portfolio.

Third, mutual funds are easy to invest in and manage. You don’t need to be a financial expert to invest in a mutual fund. Just find a fund that meets your investment goals and let the professionals do the rest. And with FundsVita, investing in mutual funds is even easier.

How FundsVita can help: FundsVita is a mutual fund distributor that can help you find the right mutual funds to meet your investment goals. They offer a wide range of funds from some of the top asset management companies in India. And with their user-friendly platform, you can easily buy and sell mutual funds from the comfort of your own home.

Conclusion: So there you have it, folks. If you want to make your rich uncle jealous, mutual funds are the way to go. They give you access to a wide range of investments, help you diversify your portfolio, and are easy to manage. If you are looking to start or consolidate your portfolio in a structured manner sign up here with FundsVita today and book a free slot with us to help you map your financial goals with your portfolio.